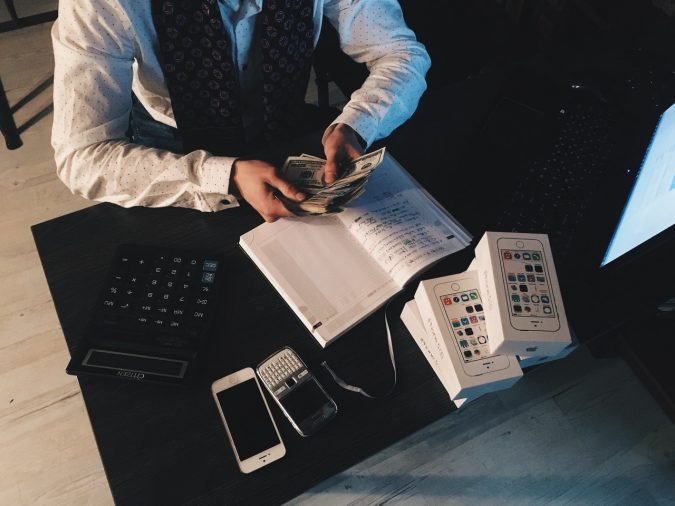

Sometimes we don’t even realize how much money we spend on things we don’t even need or things that have cheaper alternatives.

Handling money the proper way and cutting unnecessary expenses can make way for new investments. Humans are creatures of habits and our money spending habits usually need some fixing.

Check out our list of: Stylish married men of India

Here you can find out about a few tips that will help you put some extra money in your piggy bank and become a financially savvy man.

Don’t give in to your temptation

There are times when it’s difficult to control your need to buy a new piece of clothing, something that will satisfy your cravings for technology, or a pile of junk food to satiate your imaginary hunger.

Read: Movies that set the fashion scene ablaze

If you don’t think that you’ll use something in the long run or if you don’t need it at this moment, it’s better to leave it on the shelf and invest that money into something else.

Are you a fitness freak?: Check out on how you can get a swimmer’s body

You can try putting a percentage of your paycheck into a savings account each month which will help you manage the rest of it in a more careful manner. Having a savings account will keep you safe and sound even if something unplanned happens.

Plan and organize

Having a clear picture of your monthly spending on a piece of paper can help you draft a budget plan that will control your everyday expenses. It might be easy to draft a budget plan, but it certainly is difficult to stick to it. You can always start by cutting on some monthly subscriptions that you don’t use that often.

Even just a few bucks can turn into a pile of money in a few months’ time. If you don’t use something at least a few times a week, then you can live without it just fine.

Women that matter: Mansi Gupta, Founder, Tjori

Another great tip is to compare prices in-store and online and pay attention to discounts and special deals. There’s a number of websites that can help you with that, whether you’re looking for books or plane tickets.

Put more thought into the card you choose

Your credit card is an important factor in your savvy lifestyle. Depending on how much money you spend monthly, what charges you want to be included in your plan and what benefits you want, there are a few cards you have to consider before making your final decision.

All you need to know about football fashion

A new trend that is emerging lets you choose personalized payroll cards with a plethora of benefits and great deals attached. These cards can be used as debit cards and they don’t require a bank account.

There are no fees associated with paper checks and you can’t go into debt, as there’s no allowed overdraft. They also let you enjoy safer transactions and prevention from fraudulent use.

Think savvy at all times

If you don’t keep track of your expenses and don’t respect your budget limits, you might run into some financial problems.

You have to keep your credit scores neat if you want to get better deals at car loans, mortgages or even credit cards. You can save bits of money every day by fine-tuning your lifestyle. Instead of dining out in restaurants, you can cook a nice meal at home from time to time.

You don’t have to buy coffee at famous coffee shops every day and you don’t have to always buy branded clothes. A lot of savings can be made in your own home just by paying attention to how much water/chemicals/electricity you use.

Even though it’s important to live in the present, it doesn’t mean you have to go berserk and spend your paycheck in a single day.

The satisfaction of saving a great deal of money and spending it on something meaningful is just indescribable. Being a savvy man will help you invest money in your home, your new car, a holiday trip or anything that completes you. If you’re willing to do it, these tips will help you achieve your goal. Visit this website for more information and insights on finance.

What's Your Reaction?

Peter is a men's grooming & fashion writer at High Street Gent magazine from UK. Beside writing he worked as a menswear fashion stylist for many fashion events around UK & AU. Follow Peter on Twitter for more tips.